Business Insurance in and around Cincinnati

Calling all small business owners of Cincinnati!

Almost 100 years of helping small businesses

Coverage With State Farm Can Help Your Small Business.

Do you own a home improvement store, a confectionary or a dance school? You're in the right place! Finding the right coverage for you shouldn't be risky business so you can focus on making this adventure a success.

Calling all small business owners of Cincinnati!

Almost 100 years of helping small businesses

Cover Your Business Assets

The passion you have to contribute to your community is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Nathan Enger. With an agent like Nathan Enger, your coverage can include great options, such as commercial liability umbrella policies, business owners policies and commercial auto.

Since 1935, State Farm has helped small businesses manage risk. Contact agent Nathan Enger's team to identify the options specifically available to you!

Simple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

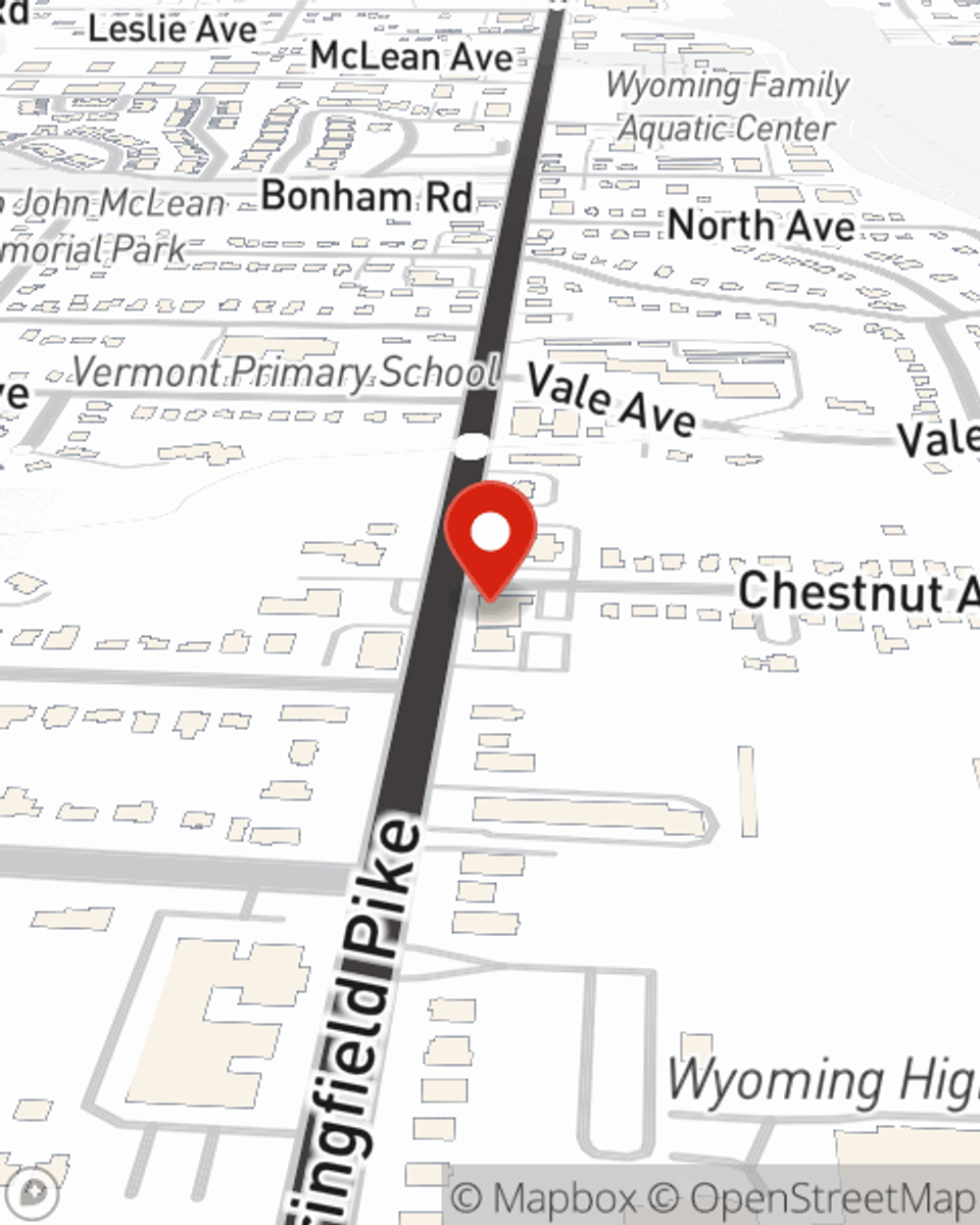

Nathan Enger

State Farm® Insurance AgentSimple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.